CPO Support: Year-End Guide

Payroll year-end is the busiest time of the year. This guide will provide tips and tricks on how to navigate client questions, year-end payrolls, and internal CertiPay processes.

Year-End Payroll Processing

1. Bonuses & Large Payrolls

-

Info on Processing/Handling

-

CertiPay will provide a client specific Year-end guide. This guide is an internal review of best practices and has important information listed for 2022 year-end processing.

Reference Materials:

-

-

-

Funding Considerations

-

During year-end there are some clients that process larger than their normal payroll liability. All clients will need to wire in funds that exceed 75k. The client will need to follow the normal protocol for wiring funds.

-

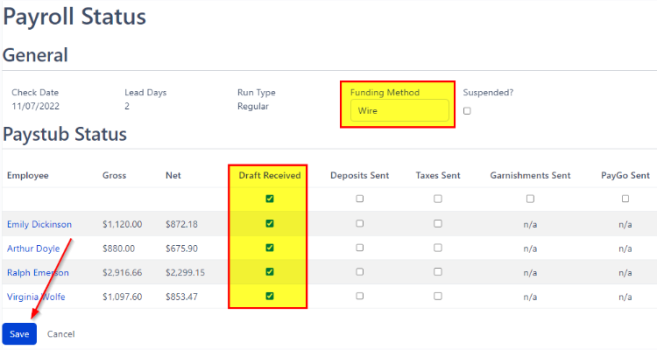

When clients are wiring funds, the payroll needs to be marked as suspended and to mark the funding box as wire. Client will need to send the wire using the wire instructions. The proper Funding macro will need to be used to let them know of the incoming wire while attaching the Cash Requirement of the payroll.

-

Once received and confirmed by Funding, you can release the suspension on the pay run. Then select Draft Received to make sure the debit will not be processed. This is important as it could cause a secondary draft to the client's account.

-

-

Earnings/ Deductions

-

During this time of the year clients want to give more to their employees. Some of the common types of earnings that are added to payroll before the year closes are:

Bonuses

Health Premiums for 2% or more for shareholders in an S Corporation

Reimbursements/Allowances

-

Reference Materials:

-

Bonus - Ticket #592100

-

S-Corp Health Expense - Ticket #594957 Ticket #592596

-

-

2. Processing "Tax Only" Payrolls i.e. all Net Pay gets allocated to FIT/SIT

Some clients tend to forget they did not have deductions listed on the employee's profile OR their accountant recommends to process a bonus payroll and have everything be sent to 401K or for federal withholding. Sometimes clients don't want taxes to be taken out of their bonuses, however, the statutory taxes (Social Security and Medicare) must be withheld. See the below work around tips for Federal Withholding and 401K deductions.

-

Federal Withholding:

-

To have a specific amount allocated:

-

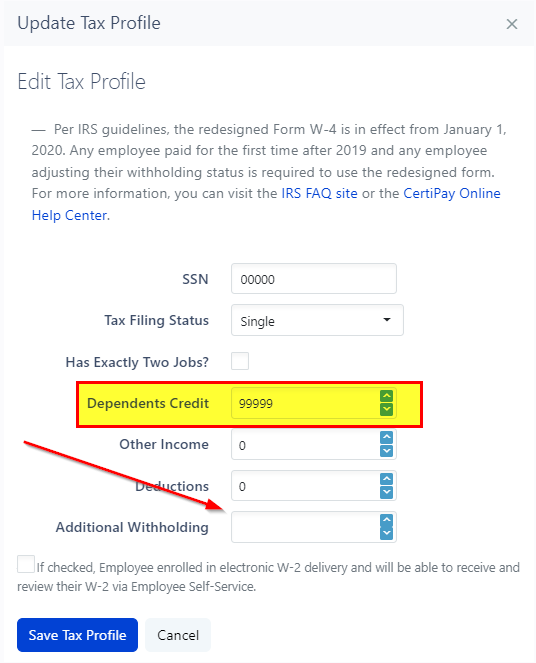

Go to the employee's federal tax profile and click manage. The client will need to enter 99999 in the dependents credit section. Then enter the desired amount the client wishes to have allocated to federal withholding in the additional withholding box.

-

To have no FIT calculated:

For client to have $0 to be withheld during payroll, they will need to do the above steps. However, they will not enter a dollar amount in the additional withholding section.

-

All to 401K:

Setup the off cycle run with the client. Assuming if the client has never created the deduction, you can do so on the enter payroll screen. Enter the amount they wish to contribute to the voluntary deduction. You will need to make sure there is an earning listed on the payroll so the payroll can process. This amount will need to be higher than the deduction amount as well as for tax purposes.

The client might ask for the payroll to net a $0 amount. You may need to adjust the earning a few times to get the amount as close as possible to 0.

-

Reference Materials:

-

401K Deductions - Ticket #591753 (12/31/2021 Pay Run ID:66049)

3. Corrections & Adjustments

-

Incorrect SSN

-

During quarter end, Taxes will provide an error report for the department. If a client has an employee with an incorrect SSN, The client will need to correct the application to represent the correct SSN. The client will need to be notified of the $250 rebuild fee and a Tier 2 escalation will need to be completed for a new RTS file for the client.

-

There has been situations where clients do not want to correct the SSN in the application and those client will be responsible for any penalties and interest.

-

-

Through Payroll vs Prior Qtr Adjustments

-

Some payroll corrections can be processed during the current quarter. However, depending the changes needed prior quarter adjustments may be required.

-

Incorrect location for prior (and current) quarters require an adjustment to be processed for each quarter.

-

Many S-Corp Health Benefit or 401(k) adjustments can be processed current quarter

We can review examples as requests come in from clients.

-

-

4. Deadlines

-

Year-End Announcements are a great reference tool for reviewing deadlines and providing timelines during client conversations and correction processing. Please note, these deadlines are not flexible.

Reference Materials:

Year-End Tax Form Handling

1. W2/1099 Processing

-

CertiPay will ensure that all W2'/1099's will be shipped by the IRS deadline.

2. W2 Electronic Opt-In

3. W2/1099 Delivery

-

The first thing that comes to mind for the end of the year are W2's and 1099's. If employees elect to have paper copies of their W2s, CertiPay will ship them to the company's mailing address. (The below is ONLY for employees as contractors do not have the same capabilities to elect electronic copies)

-

Once the W2 Printing team starts printing and shipping W2's to our clients, there will be a folder with daily updates. This folder will contain the tracking number and address where the forms will be shipped.

R-Drive > File Server > Year End > *Select year*

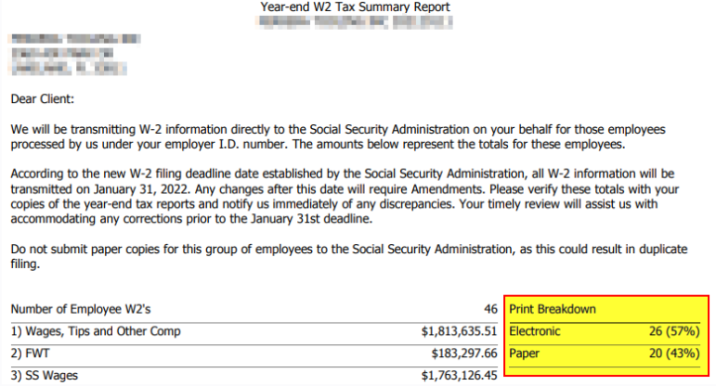

If clients are stating the W2's are not within the packaged received, you/client can check the documents section of the application for the W2 Summary sheet. This will provide the total number for W2's and the breakdown of paper and electronic copies.

4. Retrieving copies of Year-End Documents

-

Under the reports tab in the navigation panel on the left will have the PDF version of all W2's/1099's for the company. You can reference Ticket #611343 for more information. Please note, we do not send copies of the W2's/1099's through Zendesk, this will need to be an encrypted email through Outlook.

-

If the W2's/1099's are not visible to clients, you can check the STS folder in the F-Drive. This folder also contains the client's tax package.

F-Drive > PROD > STS_QTR > *Select Year*

-

Reference Materials: